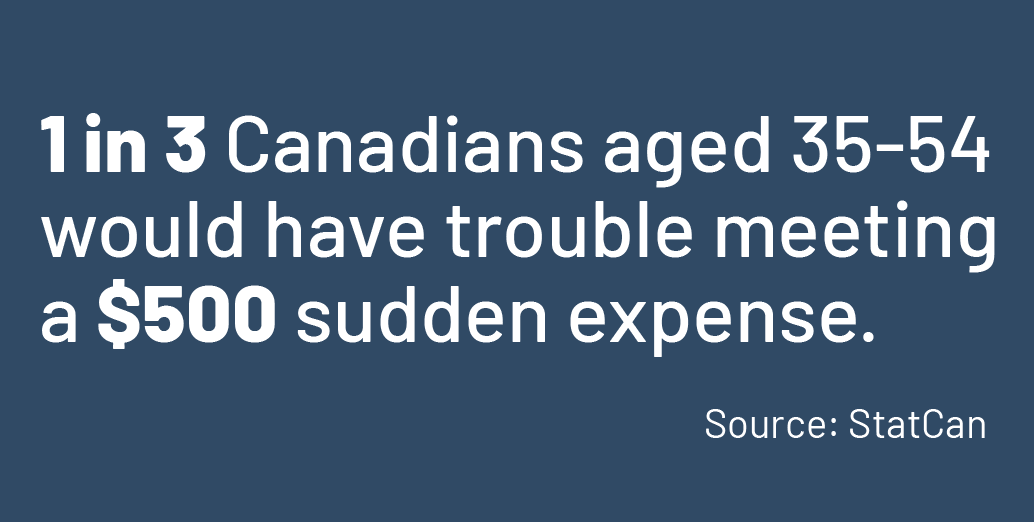

A recent Statistics Canada survey showed that 26% of Canadians would have trouble meeting an unexpected expense of $500. Even more troublingly, narrowing the sample to ages 35–54 increases that figure to 32.7%—almost one in three. With so many homeowners in a precarious position, the value of protection has never been clearer.

The risks title insurance protects against are expensive and almost impossible to predict. If one in three Canadians can’t bear a sudden expense in the hundreds, how can they handle one in the thousands?

Real title insurance claims examples

These homeowners all faced a large expense that came out of nowhere. They also had title insurance policies in place, so in each of these cases, FCT was able to cover their loss.

Sudden expense: $19,210 from NOSI fraud

When a Toronto homeowner discovered almost $20,000 in liens on her property she immediately knew something was wrong. They were for rented fixture equipment she never agreed to or purchased. It turned out her signature had been forged on four separate equipment rental contracts, and the fraudsters had registered Notices of Security Interest (NOSIs) on two of them. FCT covered her for the amount, as well as the investigation.

Sudden expense: $1,752 from open work permits

A homeowner in Fredericton was in the middle of selling his house when a title search uncovered four open work permits that the previous owner had never closed. An inspector pointed out numerous repairs needed to close the permits, totaling almost $2,000. The problem was, the homeowner was relying on the funds from the sale, which the open permits were now blocking. FCT paid for the repairs and coordinated with the purchasers’ lawyer to make sure the sale closed smoothly.

Sudden expense: $72,618.92 from a condo special assessment

The new owner of a condo near Vancouver was ready to move in. She’d just received the Form B from the condo corporation, and it showed everything was in order. But just a few days before, the corporation had notified all the unit owners about a large special assessment for repairs to the building envelope. That information wasn’t in the new owner’s Form B, so when the charge came, it was a total surprise to her. FCT was able to cover the full amount of the improperly communicated special assessment.

The value of title insurance

Title insurance is a one-time investment that can prevent massive losses for homeowners. A $72,000 expense doesn’t come up every month, but it only takes one. When you’re buying a home, rely on a title insurance policy for peace of mind for as long as you or your heirs have an interest in the property. Don’t gamble with your biggest investment—protect it with homeowner’s title insurance from FCT.

Insurance by FCT Insurance Company Ltd. Services by First Canadian Title Company Limited. The services company does not provide insurance products. This material is intended to provide general information only. For specific coverage and exclusions, refer to the applicable policy. Copies are available upon request. Some products/services may vary by province. Prices and products/services offered are subject to change without notice.

®Registered Trademark of First American Financial Corporation.

-min-1.jpg?width=350&height=216&name=home-theft-tile-fraud-toronto-blog%20(3)-min-1.jpg)

-min.jpg?width=350&height=216&name=FCT-Leading-Insights-Michael-LeBlanc-ENG_blog%20(1)-min.jpg)

-min.jpg?width=350&height=216&name=errors-and-omissions-ontario-real-estate-law-risk-blog%20(1)-min.jpg)

-min.jpg?width=350&height=216&name=Three-signs-your-clients...-Blog%20(1)-min.jpg)

.jpg?width=350&height=216&name=Blog-Post-EasyFund-2-Steps-min%20(1).jpg)

-min.jpg?width=350&height=216&name=June-28th-Were-so-Canadian2%20(1)-min.jpg)