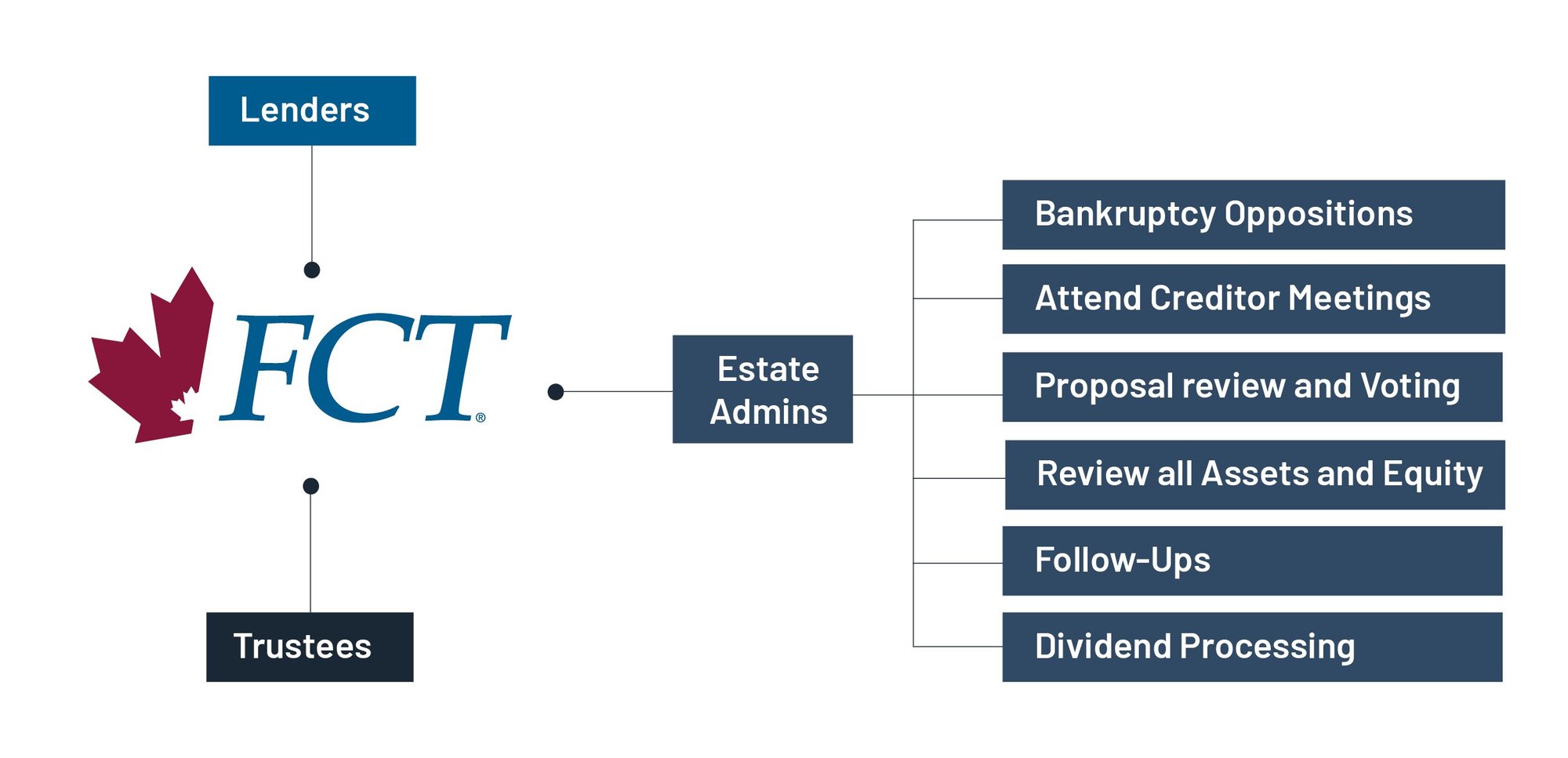

Leverage our automated estate intakes, host system integration and direct connection to a majority of licensed insolvency trustees in Canada, allowing you to focus on other important tasks.

Insolvency managed services

Processing bankruptcies, consumer proposals, credit counseling and voluntary deposit files can be costly and onerous. From initial filing through to final payment processing, FCT can help you move forward with confidence.

Working with the experts

FCT is the leading provider of insolvency management services to financial institutions and software to Licensed Insolvency Trustees (LITs). With 95% of all consumer insolvency filings passing through our system, we have unique access to extensive data. We regularly analyze the data to identify valuable and actionable trends for our customers, supporting informed decision-making and operational efficiency.

InsolvencyLink

Our platform simplifies the process of estate intakes with automated tools that reduce manual effort and minimize errors. Real-time tracking of documents and payments ensures transparency and accountability. The user-friendly interface allows creditors to easily access scanned documents, customize reports and send documentation via email or automated fax software. Seamless communication enhances interactions with stakeholders, ensuring that all parties are informed and aligned.

Key benefits of using FCT’s managed insolvency services

Save time and money

Gain wider access

InsolvencyLink stores transaction information so creditors can easily access everything they need in a user-friendly interface. View scanned documents, track payments and dividends, customize reports and send documentation via email or automated fax software.

Process less paperwork

Many documents you currently file to the trustee are auto-populated within InsolvencyLink and automatically sent electronically.

Get expert service

FCT meets regularly with representatives of the regulator to stay on top of industry developments and regulatory changes.

Maximize recoveries

Increase recoveries with our unique estate management strategies, combining a powerful and industry-leading software platform with our in-house experts.

Enhance voting power on consumer proposals

FCT provides managed insolvency services for several large creditors, giving us the majority vote on many estates and allowing us to influence fair proposals in many cases.

Automatically track files

Stay consistently in the loop via an automated follow-up process, including the automatic intake and notification of key documents as they’re received from the LIT or credit counselling office.

Enjoy effortless dividend payment

Our estate administrators will receive payments from the LITs and directly submit batch funds to you via EFT.

Comprehensive insolvency solutions

With our InsolvencyLink platform and dedicated default solutions team, we simplify the collection and recovery process for these main types of insolvencies:

Bankruptcies

Our business solutions specialists are experienced in dealing with LITs, ensuring that we maximize the amount of funds.

Consumer proposals

InsolvencyLink is about more than bankruptcies. If a debtor is looking to settle their debts, we will ensure that a fair settlement is obtained and funds are recovered.

Credit counseling

If you have a debtor that is overwhelmed with payments but wants to work out a solution, we can help. We work with credit counsellors to help facilitate repayment.

Voluntary deposit

When a debtor is looking to avoid bankruptcy, a voluntary deposit is a possible solution. Our team is experienced with the legal aspects of this process and can set up a payment schedule.

Orderly payment of debt*

This is a legal proceeding that will consolidate debts and is binding on all creditors and administered through FCT. The Court determines monthly payments, money is paid into the Court over a set period of time, after which payments are disbursed to creditors on the debtor’s behalf.

A human-centric approach

At FCT, we believe in the power of collaboration and a human-centric approach. Our solutions are designed to enhance communication and drive more efficient resolutions while maintaining strict privacy. Our team acts as an extension of yours, providing the insights and information you need to stay competitive and achieve the fastest, most cost-effective and fairest outcomes. With our vast, real-time data and actionable insights, you can make informed decisions and simplify the collection process.

Join us in our mission to transform the recovery landscape. Together, we can achieve more.

Ready to transform your insolvency management process?

Contact us today to learn more about how FCT and InsolvencyLink can support your recovery efforts.

*This option is available in select provinces under the Bankruptcy and Insolvency Act.

Services by First Canadian Title Company Limited. The services company does not provide insurance products. Some products/services may vary by province. Prices and products/services offered are subject to change without notice.

®Registered Trademark of First American Financial Corporation.